As the year wound down and we brought 2018 to a close, your nonprofit may receive requests for W-9 forms from companies you’ve done business with over the course of the year. You may think of a W-9 as a form that only applies to independent contractors (and, for the most part, you’d be correct), but a company can request one if your nonprofit has provided them services during the year.

If you have specific questions or need assistance, reach out to a qualified Nonprofit Attorney or Business Attorney at SLG.

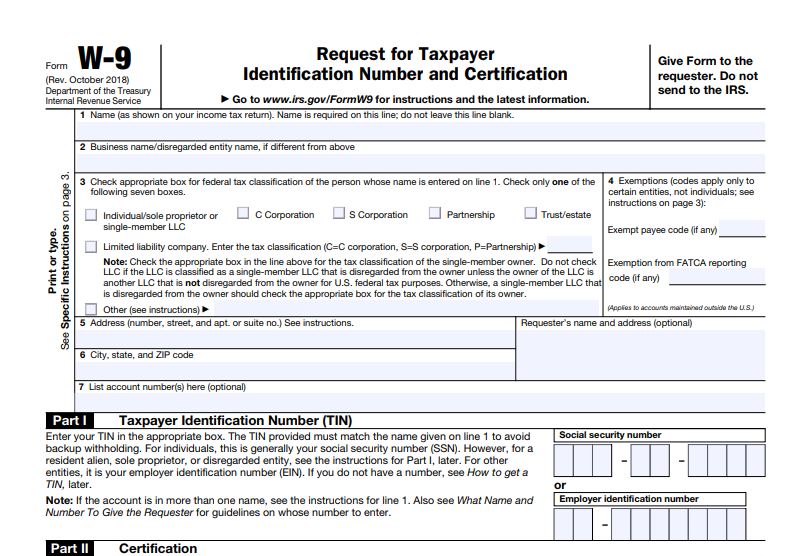

While the W-9 is a fairly straightforward (and quite short) form, there are still some things you should know about when you need to provide one. Here, we’ll discuss what a W-9 is, what it’s meant to do, and how and when to complete one.

What Is A Form W-9?

The purpose of a W-9 is to provide the tax information for non-employee entities that companies paid to perform services. While this form is generally used by people like independent contractors, consultants, and other small businesses, your nonprofit entity may be asked to complete a W-9 by a company it performed services for during the year.

Nonprofit corporations are classified as tax-exempt by the IRS, meaning they aren’t subject to the same taxation as for-profit corporate entities. However, nonprofits are still required to fill out a W-9, Request for Taxpayer Identification Number and Certification, if they provide services to another business. This form provides the taxpayer ID number for any company with which your nonprofit did business during the year.

The W-9 is helpful because it allows businesses to accurately report the payments they made to other businesses or individuals during the year. While the W-9 isn’t sent to the IRS, it is still an important part of filing taxes — it’s used to help file forms like the 1099-MISC and other 1099 Forms. If another business asks your nonprofit to complete a W-9, you are required to do so regardless of your company’s tax-exempt status.

Where Do I Get A W-9 Form?

In most instances, the business or entity requesting the W-9 will provide you with a blank one, which you will then fill out with your information and return to the requesting corporation or business. If you find you need to issue a W-9 to a consultant or independent contractor, you can find one directly from the IRS here.

How Do I Fill Out A W-9?

The W-9 is, thankfully, a short form that requires relatively little information on your part. That said, it does require some sensitive information that you shouldn’t be giving out to just anyone. Do not send a W-9 to a person or entity you do not know or have not done business with, and be sure to send your W-9 through a secure method of delivery, such as hand-delivery, mail, or an encrypted email.

In terms of what information to include, the form is pretty straightforward: start by entering the legal name of your nonprofit in the first line. This should be the legal name of the corporation listed on all tax forms and corporate documents. If your nonprofit does business under a separate name, then write that name on the second line of the form.

Next, you’ll check the box titled “Other” on Line 3 and write a (brief!) explanation that your corporation is tax-exempt based on the IRS Code Section that applies to your organization. For most nonprofits, this code is 501(c)(3), which is the section that designates charitable organizations. However, if your organization is classified as a nonprofit under a different IRS Code Section, cite that section.

You’ll skip line 4, which asks for an exempt payee code or exemption from the Foreign Account Tax Compliance Act reporting code. Charitable and nonprofit organizations should leave this line blank — if you’re a for-profit entity, ask your tax expert for advice on what code you should use.

On Lines 5 and 6, enter your nonprofit’s address. Next, you’ll enter your Taxpayer Identification Number, or TIN, in the section titled “Part I.” Your TIN is essentially a Social Security number for your nonprofit and was issued to you by the IRS for tax purposes. If haven’t received your TIN by the time you need to send the W-9, or haven’t applied for one (get on that!), you may write “Pending” in the provided space.

Finally, you’ll need to sign the W-9 next to the words, “Signature of U.S. person,” and date it to verify that the information you’ve entered is accurate. This also certifies that, according to IRS regulations, your nonprofit is tax-exempt and therefore not subject to backup withholding. Send the form to the business who requested it through a secure avenue. You don’t need to copy the IRS, so don’t worry about putting them in the loop — just send the form to the business that requested it and you’re all set!

The forms aren’t complicated or time-consuming to fill out, but you’ll need to complete them for any company you’ve done business with who has requested one from you. Since they contain sensitive information, make sure you know the entity requesting the W-9 and send the document through a secure mode of communication.