The SLG Blog

The Latest Legal News in Nonprofit, Business, and Estate PlanningFive Steps to a Successful Small Business

Success in the world of business is rarely easy to accomplish. Many small businesses simply break even each year while others end up closing their doors altogether. Luckily though, there are some steps that you can take to maximize your chances of finding sustained...

California Nonprofit Tax Filing Deadline Looming

The Tax Filing Deadline Is Looming For California-Based Nonprofits While April 15th has long been tax filing deadline day for most Americans, California-based nonprofit organizations must instead have their state and federal taxes filed by May 15th. With that date...

Probate Process

Overview of the Costs and Complexities of the Probate Process The Probate process represents one of the most complicated sets of laws in the state of California or anywhere else in the United States. Although each state has its own probate code, or set of probate and...

What Is An 83(b) Election

An 83(b) election (here's the code) can effectively accelerate your income tax and save you money by allowing equity you receive to be taxed before it is vested in a company, rather than after (we’ll talk more about what this means in practical terms in a moment). It...

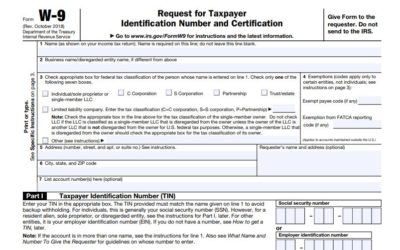

What Is A W-9?

As the year wound down and we brought 2018 to a close, your nonprofit may receive requests for W-9 forms from companies you’ve done business with over the course of the year. You may think of a W-9 as a form that only applies to independent contractors (and, for the...

What Are Self Employment Taxes?

If you work for someone else, your employer handles your tax withholdings for you. That’s not the case when you work for yourself, though: you are still responsible for paying those taxes, but the responsibility for withholding falls to you. In the state of...

What Is A 1099?

If you’re self-employed, work as an independent contractor, or operate a business that hires independent contractors to complete work for your company, you’ve likely heard something about a 1099. What Is a 1099? While wages and salaries are reported on the form W-2,...

Statement of Information

In the state of California, LLCs and corporations are required to file an annual or biannual Statement of Information with the office of the Secretary of State. While it may be tempting to delay filing - after all, running a business keeps you busy - it’s important...

Nikki Semanchik

Founding Attorney

Nikki has been practicing law since 2011. She founded SLG in 2017 with the goal of assisting Entrepreneurs, Philanthropists & Families realize their dreams.