A Step-by-Step Process on How to Start a Business

When determining how to start a business, there are many factors to consider. Semanchik Law Group (SLG) attorneys are experts in business law and will help you figure out the path you need to take. SLG will walk you through launching your business and will provide insight before you get started.

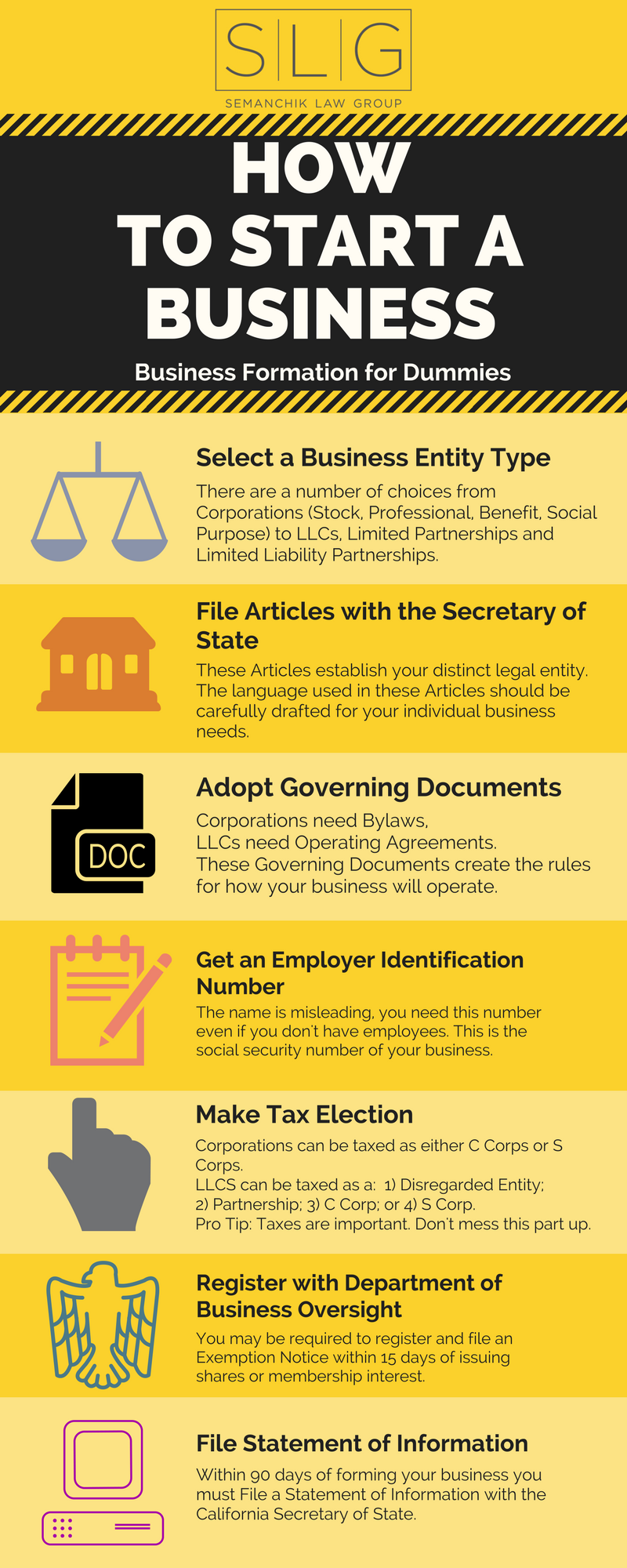

First and foremost, new business owners need to consider what type of entity they would like to form. Every situation is different and it is imperative to speak to an attorney before you make any decisions. Once you have selected the best entity for you, the next step is to file articles with the Secretary of State.

Following the business formation, new business owners need to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). The process of obtaining an EIN from the IRS does not take very long but choosing the wrong entity can be devastating for future reporting requirements. This number is similar to an individual’s Social Security Number. It acts to identify the business to the IRS for tax purposes.

Once you have an EIN, new business owners need to choose a tax election. Note: when an individual asks to form an S Corp, they are really choosing a tax election, not an entity type. From there, a business owner will file with the Department of Business Oversight. Finally, you must file a Statement of Information with the Secretary of State.

Forming your business is only the beginning of the process. Depending on the entity type, businesses carry annual requirements including filing requirements, fees, notices, and tax payments. SLG can not only help you start your business, but they will ensure you are compliant for years to come. Request a free consultation from a qualified attorney today!