by Nikki Semanchik | Oct 21, 2019 | Business Law

California Professional Corporation Requirements As any California business lawyer will tell you, limited liability companies and traditional corporations have long been the chosen structure of most new companies in the state. If you have walked into a grocery store,...

by Nikki Semanchik | Aug 7, 2019 | Business Law

Things to Consider Before Deciding on a Legal Structure for a Small Business When starting a new business in San Diego, one of the first, and most important, things you will need to do is decide on the legal structure that your company should take on. After all, this...

by Nikki Semanchik | Jul 12, 2019 | Business Law, General Counsel

The Importance Of Privacy Policies When starting a new online business, you are much more likely to focus on building relationships with vendors and hiring employees than creating a privacy policy. “Nobody ever reads them anyway,” you might think. In...

by Nikki Semanchik | Jul 7, 2019 | Business Law

How Much Compensation Should S Corporation Shareholders Receive? When you run your own business, self-employment taxes are a fact of life. However, if you are interested in reducing your annual tax burden, it may be worth exploring the possibility of filing as an S...

by Nikki Semanchik | Jul 7, 2019 | Business Law

Four Benefits Of Working With An LLC Attorney To Start Your San Diego Small Business If you are keen to save money on LLC lawyer fees when starting your San Diego business, you might be tempted to handle the process alone. However, forming your business without the...

by Nikki Semanchik | May 8, 2019 | Business Law, General Counsel

Success in the world of business is rarely easy to accomplish. Many small businesses simply break even each year while others end up closing their doors altogether. Luckily though, there are some steps that you can take to maximize your chances of finding sustained...

by Nikki Semanchik | Jan 11, 2019 | Business Law

An 83(b) election (here’s the code) can effectively accelerate your income tax and save you money by allowing equity you receive to be taxed before it is vested in a company, rather than after (we’ll talk more about what this means in practical terms in a...

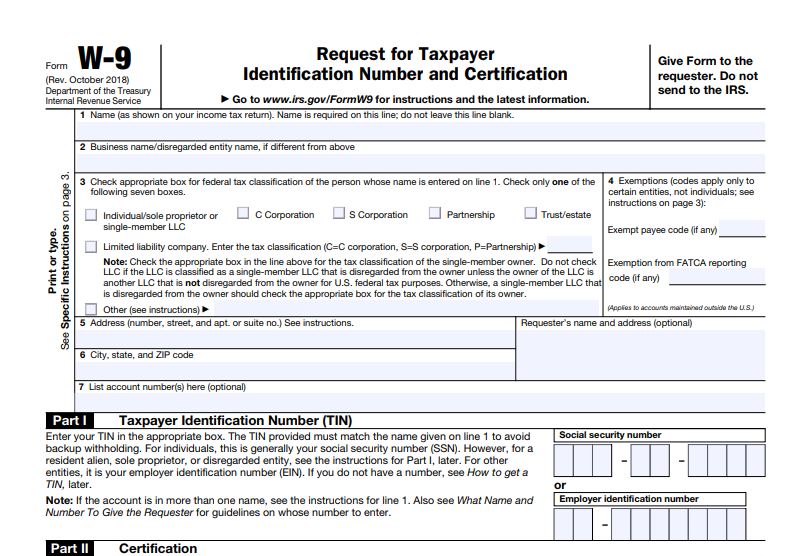

by Nikki Semanchik | Jan 3, 2019 | Business Law, General Counsel, Nonprofit Law

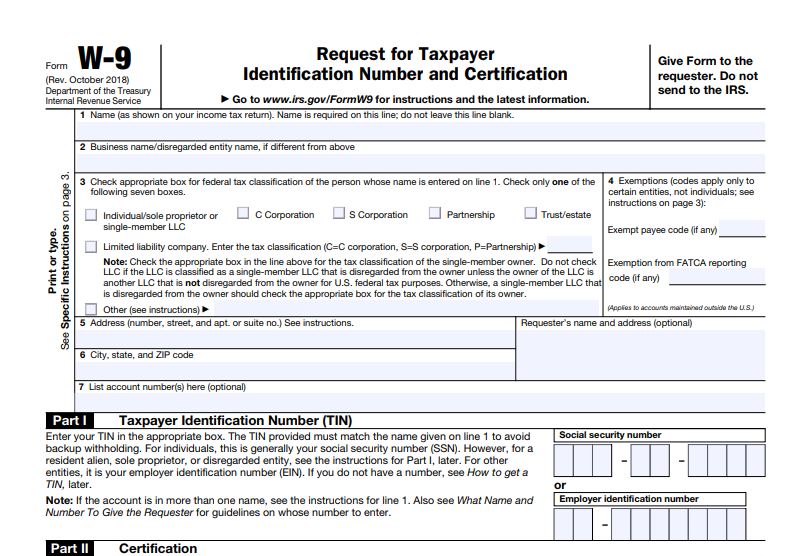

As the year wound down and we brought 2018 to a close, your nonprofit may receive requests for W-9 forms from companies you’ve done business with over the course of the year. You may think of a W-9 as a form that only applies to independent contractors (and, for the...

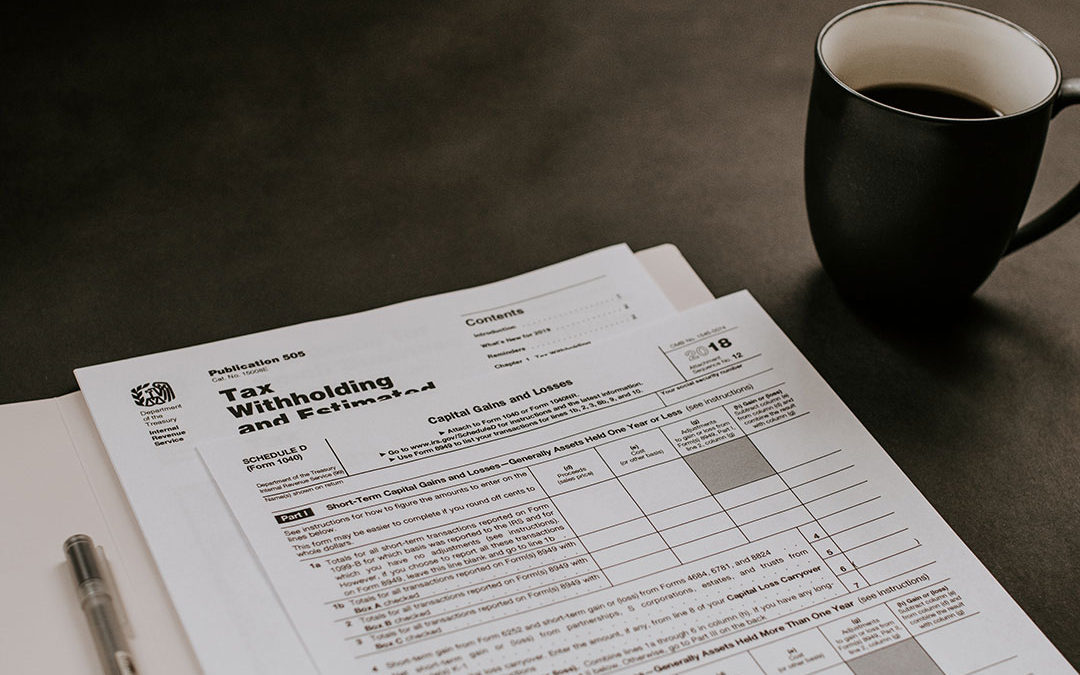

by Nikki Semanchik | Jan 2, 2019 | Business Law, General Counsel

If you work for someone else, your employer handles your tax withholdings for you. That’s not the case when you work for yourself, though: you are still responsible for paying those taxes, but the responsibility for withholding falls to you. In the state of...

by Nikki Semanchik | Dec 14, 2018 | Business Law, Nonprofit Law

If you’re self-employed, work as an independent contractor, or operate a business that hires independent contractors to complete work for your company, you’ve likely heard something about a 1099. What Is a 1099? While wages and salaries are reported on the form W-2,...